Compound interest calculator daily contributions

Compound interest calculator increasing contributions. 110 10 1.

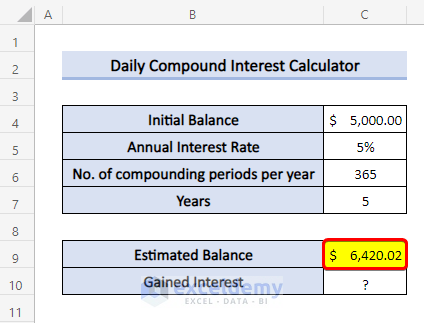

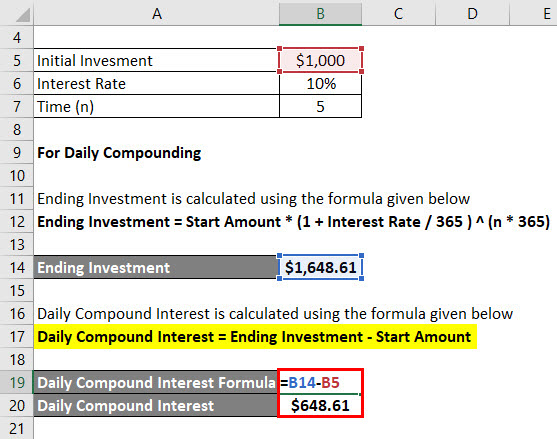

A Daily Compound Interest Calculator In Excel Template Attached

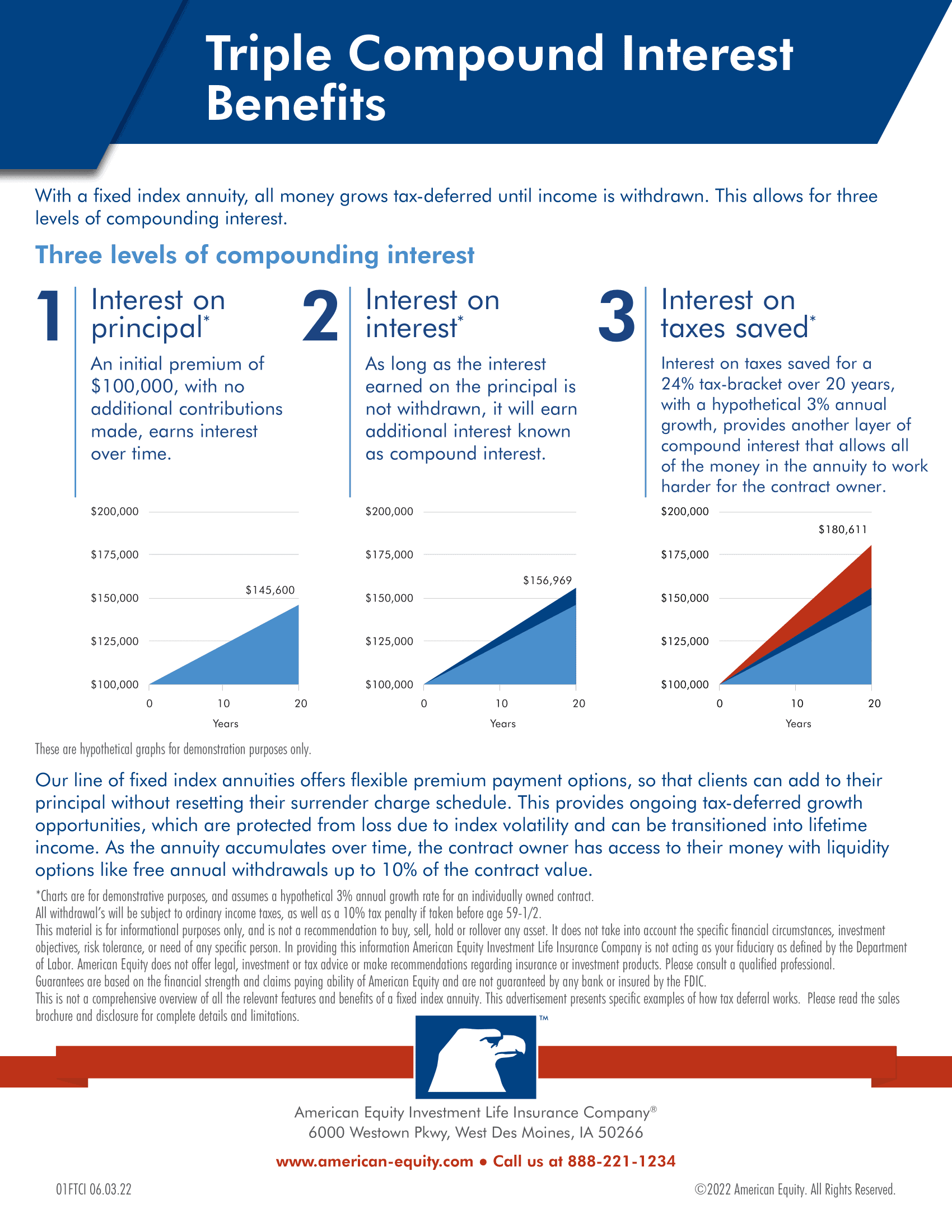

Still one thing is very sure that you will be earning.

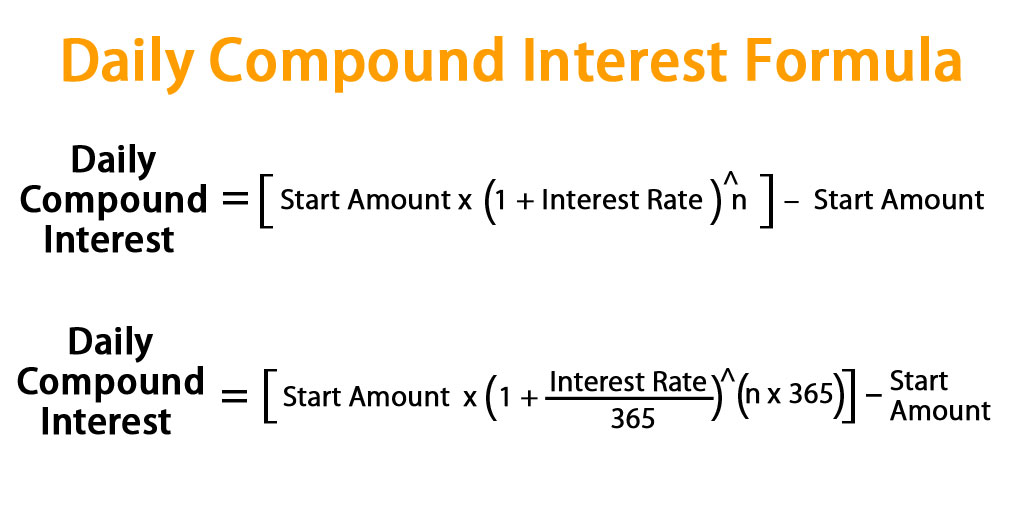

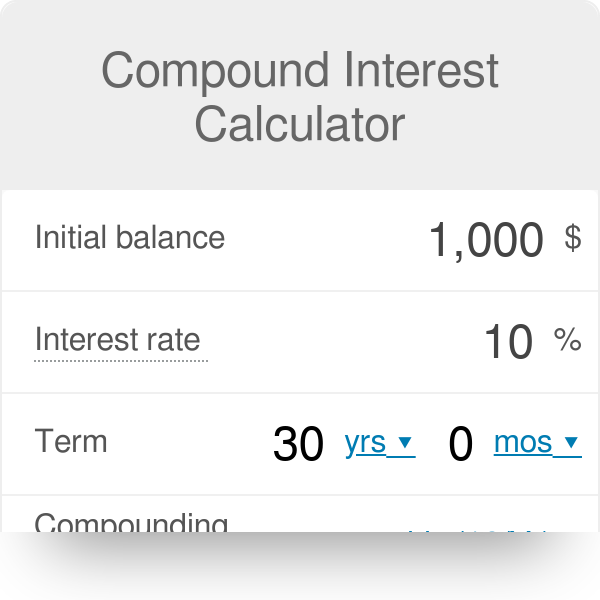

. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. Enter your initial amount contributions rate of return and years of growth to see how your balance increases over time. Many banks compound interest daily but some compound it weekly monthly or even quarterly.

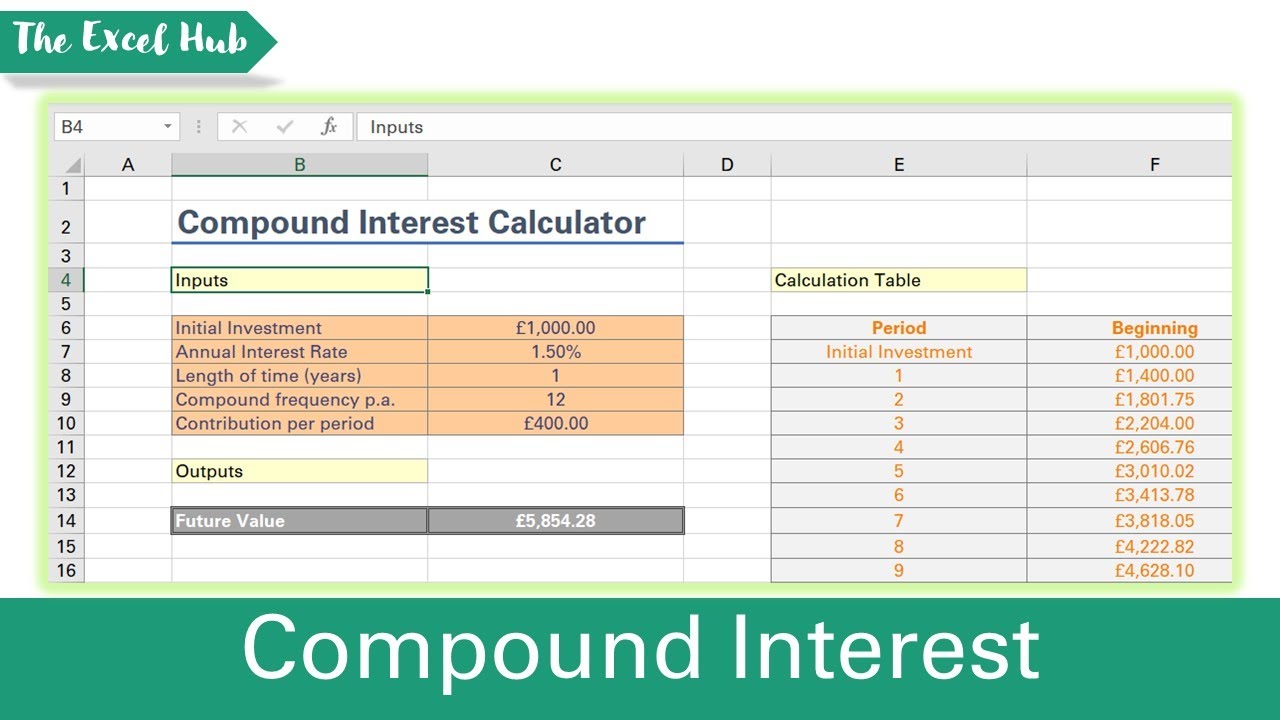

There are two distinct methods of accumulating interest categorized into simple interest or compound interest. The second tab is a graphical calculator where you can enter a starting savings amount how long you plan to save for the anticipated rate of return on your savings a frequency of contribution. You can calculate based on daily monthly or yearly compounding.

If you have selected monthly contributions in the calculator the calculator utilizes. Estimated Rate of Return Compound Frequency. Most bank savings accounts use a daily average balance to compound interest daily and then add the amount to the accounts balance monthly.

Most years have 365 days while leap years. Ad Theres no minimum balance to open a CD account. Get peace of mind with fixed rates and guaranteed returns.

To use the compound interest calculator. We started with 10000 and ended up with a little more than 500 in interest after 10 years in an account with a 050 annual yield. MoneyGeeks compound interest calculator calculates compound interest using the above formulas.

The speed of your money increment depends on your compounding period. Many banks compound interest daily but some compound it weekly monthly or even quarterly. This compounding interest calculator shows how compounding can boost your savings over time.

Most years have 365 days while leap years. Thus the interest of the second year would come out to. The NPS calculator helps an investor estimate the amount to be invested to.

Most bank savings accounts use a daily average balance to compound interest daily and then add the amount to the accounts balance monthly. But by depositing an additional 100 each. Deposit what works best for you.

The following is a basic example of how interest works. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Estimate your savings or spending through compound interest.

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Formula And Calculator

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Calculator In Excel Calculate Savings Using Fv Function Youtube

Compound Interest Calculator With Formula

Compound Interest Calculator Credit Karma

Compound Interest Calculator And Formula Wise

Compound Interest Calculator Daily Monthly Quarterly Annual

Dow Stock Market Return Calculator Investing Stock Market Financial Calculators

Compound Interest Calculator For Excel

Pin On Spreadsheets

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Compound Interest Formula And Calculator

Daily Compound Interest Formula Calculator Excel Template

How Do Investments Add Up Over Time Check Out This Compound Interest Calculator Interest Calculator Investing Compound Interest

Compound Interest Formula And Calculator

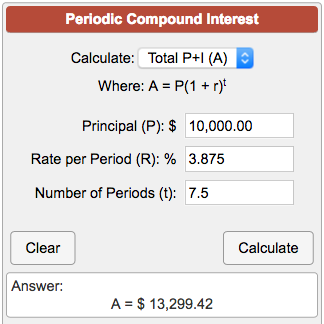

Periodic Compound Interest Calculator